REPORT

Numeracy & Financial Literacy Training

Empowering Widows in Need

Dec 2019

Vision21 & Islamic Relief Pakistan

Why Numeracy & Financial Literacy?

Numeracy is the ability to count, read and write numbers, and apply basic mathematics in everyday life. Financial literacy is the education and understanding of various financial areas including topics related to managing personal finance, money and investing.

The definition is simple to understand. Here is why numeracy and financial literacy is important for women:

According to an estimate around the world 130 million girls are out of school. Because girls are less likely to go to school, adult women are more likely to lack basic numeracy skills. It is observed that people without numeracy skills suffer worse disadvantages than those without literacy skills.

Numeracy and financial literacy encompass all aspects of life. Specially for women this could mean more empowered role in the household and in the society in general. They can gain more decision – making power regarding household finances, prioritizing, budgeting and planning future. Women without numeracy skills are more vulnerable to fraud and suffer worse disadvantages both in personal and professional lives. Innumeracy also makes everyday tasks hard for women such as reading and paying bills, checking price lists, reading a thermometer if a family member has fever, helping children with their homework, counting money and making quick estimates while shopping.

The skill of numeracy gives a life long confidence in women to make decisions and operate in daily life routine. Besides the financial matters numeracy can enhance their capacity to memorize numbers such as the telephone numbers of friends and family, emergency help or police. They can have better mental picture of spaces and their capacities, weights and quantities and also time and distances. All these advantages add to the efficiency and effectiveness of the women with numeracy skills.

Numeracy & Financial Literacy

Vision21 is an independent, Non-Governmental, Not-for-profit organization with a mission to work towards developing and improving human-capital in Pakistan. Through its projects and programs, the organization is aiming at education, women empowerment, rights awareness, poverty alleviation and promotion of justice as a right and obligation.

Vision21 has conducted a special training program about Numeracy & Financial Literacy for widows in Rawalpindi in partnership with Islamic Relief Pakistan (IRP) through its developmental program ‘Empowering Widows in Need’ (EWIN). The program helped 290 women from 10 areas of Rawalpindi, the district populating around 26 million women. This area suffers from difficult circumstances of traditional norms and economic conditions. Women’s status in all aspects of social, cultural, and economic life across the country is inadequate whereas widows are more vulnerable marginalized group that suffer challenging living standards and psychological implications.

Among the trainees 80% women were non-literate and innumerate. More than 90% of the women who participated in the program were head of the households and the only bread – winner for their families. These women were trained on vocational skills including industrial stitching and manufacturing, self-grooming, dress-designing and cooking & baking to help them generate income, raise their families, and raise their living standards.

Objectives

- Providing Capacity building for 300 widows on Numeracy & Financial Literacy, to make them productive and independent individuals.

- Introducing them to the small business plan and budgeting

Topics of the training course

- Arithmetic applications and their use in day to day life

- Time and Distances, Measurements

- Fractions and Percentage

- Budget (Household and Small Business)

- Money (Income, saving, investment)

- Inflation

- Demand & Supply

- Profit & Loss

- Banks & Loan

Course Duration: Dec 2019

Success Stories

Shumaila

Shumaila, mother of 2 sons, has been the head of her household since last 7 years when she got widowed at the age of 26 years. Shumaila’s husband died of heart-attack when the family was planned to move to Canada in a few weeks. This sudden death changed the whole scenario for Shumaila and her children altogether. But the young lady took the decision raise her sons on her own not letting their future affected by the huge loss they faced. Initially she started out with giving home-tuitions to only 4 children but later on the no. increased and her cousin also helped her with teaching science subjects to her students. Currently Shumaila is the in-charge of Hunar Ghar in Khayaban-e-Sirsued area of Rawalpindi. Shumaila plans to learn baking and have her own all women bakery in near future.

Sajida

Sajida’s husband passed away when she was only 25 years. She had a daughter and a son at that time. After her husband’s death she faced hardships in getting her space as a single mother. Her in-laws family refused to support her and the 2 children. Sajida did not want to be a liability for anyone, so she decided to make her own way by learning skills. She continuously worked with different welfare organizations. At present Sajida runs the skill center of IRP named Humar Ghar in Baharakahu area of Islamabad and helping many other widows like herself to learn and be independent.

Masooma

52 years old Masooma lost her husband in her youth. She was left with 3 sons. But after the death of her husband, as the tag of ‘widow’ got attached to her identity like a parasite, she realized that she would not be the victim of her story. She started out with a small shop in her house. Initially, she cooked food items and sold but gradually she added more items to her shop and grew her business. Masooma’s all 3 sons are studying and she is single handedly taking care of the running of house as well as the education of her sons. Masooma took great interest in learning the small business models and marketing strategies during the workshop on Numeracy & Financial Literacy. She plans to expand her business and use new marketing ideas to enhance her profit.

Project outcomes

It is an established fact that financial literacy and Numeracy are very important skills to make financial decisions in life. We also know that unfortunately a large no. of women are illiterate and innumerate in Pakistan. Moreover when it comes to the women falling in the age bracket of 45 to 55 years the facts get even worse.

During the training workshops on Numeracy and Financial Literacy, 290 widows were trained with Numeracy and Financial Literacy building their capacity and to enable them to participation in public life.

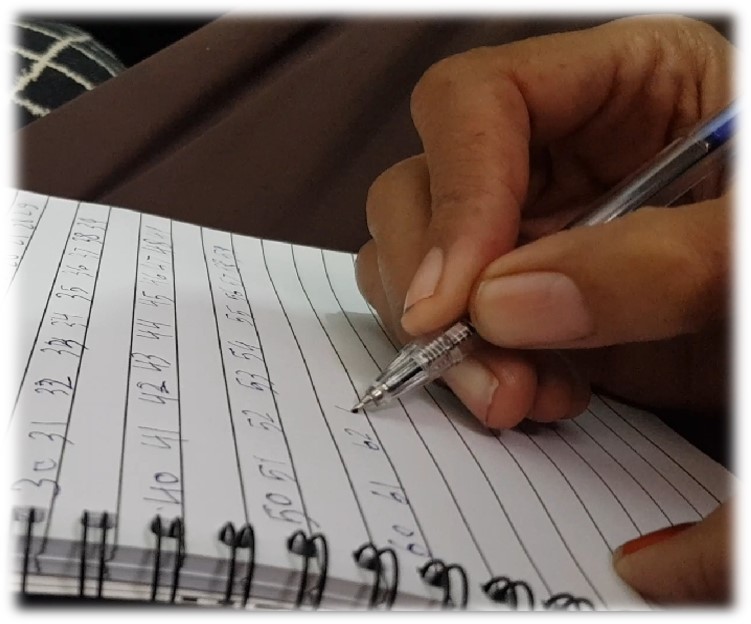

there were around 50% trainees who were innumerate and could not even write the counting and simple numbers. They never learned the counting due to a pre-conceived image about mathematics beings a difficult subject. But in the 2 days training the trainees were pleasantly surprised to discover that the notion was incorrect and they could learn all of the basics in such short period of time. The women felt confident and keen, more than ever before, to learn new things.

Among the trainees only 10-15% had their own bank accounts. A large majority of the trainees did not know about the basic transactions performed through the bank. All the trainees were positively engaged in learning about how a bank functions, the concepts of debit, credit, saving, income and profit.

The most favorite topic during all the workshops at different centers had been Money and financial literacy. Beings the house-runners the widows have the firsthand experience of market changes and the dynamics of money. It was very simple for the trainees to understand how the laws of demand and supply affect price, what is inflation and what are the factors changing the value of money.

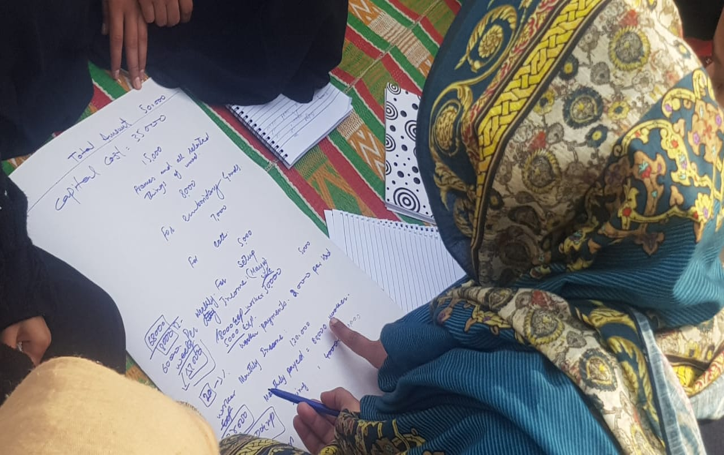

Eventually, the small business model and budget was the subject that had everyone’s attention and interest. The groups of trainees presented their own models with budgets of the startups and estimates income and profits. The exercise helped them thinking deep and critically which is necessary for developing their entrepreneurial skills. Some of the start-up ideas included Beauty Salon, Designers Boutique, restaurant, school canteen, frozen-food supply and stitching & sewing center.

Challenges

- The women had their routine domestic responsibilities such as picking up children from schools or looking after family members at home due to which they were pre-occupied and could not give proper time to the training workshops.

- Most women did not have any educational background, the ones who were educated up to matric were out of touch with education for a long time so the time of the training was less for delivering the target objects considering their educational levels.

- At some centers the space for training was not sufficient enough to carry out the activities.

Opportunities

-Selection of widowed women from within the hard-to-reach areas in Rawalpindi district gives them an opportunity to get a platform for further learning and capacity building.

-Selecting a skillful well known female trainer, focusing on practical aspects and hands-on job training, who can follow up the learning of the training workshops.

-Introducing the trainees with basic concepts of small business, income, saving and investment and how money circulates gives them an understanding of business which is an encouragement for them to enhance learning and use their skills in a professional manner.

Lessons learned

Special projects for widows are most required opportunity to uplift their economic and social conditions. Considering the local culture of the target areas a platform in shape of the skill centers is a significant support for the marginalized group which not only is a place where they can learn but also build social network and have a pleasant environment out of their stressed routines. Building partnership with, and taking advantage of, local expertise and partners made implementation easier. On-going follow up of the project by the staff, and frequent field visits.Recommendations:

Providing other training courses on entrepreneurship, management, marketing, and accounting for those who had access to primary education. Continuation of financial literacy and business planning workshops to enable the trainees acquire the professional skills. Organize the events and engage the trainees in events showcasing their work Support the trainees to build linkage with the market in order to have their start-ups after completion of the vocational skills training.